Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

This title is printed to order. This book may have been self-published. If so, we cannot guarantee the quality of the content. In the main most books will have gone through the editing process however some may not. We therefore suggest that you be aware of this before ordering this book. If in doubt check either the author or publisher’s details as we are unable to accept any returns unless they are faulty. Please contact us if you have any questions.

Long term deflation will cause all asset prices to collapse by 80-90%, so it's a golden opportunity to go from laborer to capitalist, from nothing to get rich, as long as you prepare ahead of time.

The Long Term Deflation is a war of survival: get rich or get wiped out. Very little economic data from 1929 remains for the United States. Japan's data from 1990 2023 is the only one worth analyzing and studying. Even globally, there is very little data on long term deflation, let alone the usual short term deflation line.

Japan's long term deflation data and so on, are thankfully updated and published monthly by FRED. It was a great pleasure for the author to be able to cite these sources to verify almost all of his arguments.

This book is the first general theory of long term deflation. In a nutshell, long term deflation is a proportional decline in the price of the dollar and the price of everything else in the world over a period of 5 to 30 years.

According to the author's diamond dollar investment method, the dollar and the price of goods should be inversely proportional. However, the opposite phenomenon occurs: a direct relationship between the dollar and the price of everything in the world, lasting 5 30 years.

If we analyze Japan in December 1988, the domestic dollar price and the Nikkei 225 stock price rose about 30% in proportion for about a year. It was a sign of the beginning of long term deflation.

Now, in South Korea, the domestic price of the dollar and the domestic stock market are surging.

The U.S. Great Depression of 1929 was the world's first long term deflation, and Japan's in 1989 lasted 32 years. In a long term deflation, the price of everything in the world, and the dollar, is constantly falling, so there is almost nothing to invest in, and the only asset that can be invested in is government bonds, which we will discuss in detail in this book.

This book is the first book to focus on this phenomenon of long term deflation, and it emphasizes why deflation should be divided into short term and long term deflation, and how these two types of deflation differ.

This book is not a research book or an economics text, but an investment theory book, and summarizes the results of research on long term deflation to be used as an investment method as much as possible. I have already announced that there is an investment order among the top five assets in the asset market.

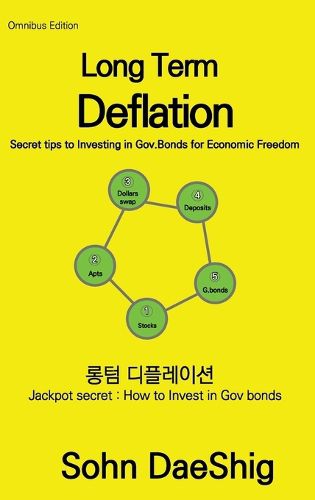

It involves rotating through five assets: stocks, apartments, dollars, deposits, and government bonds. This is what the authors call the pentagon asset cycle investing method because it's a pentagonal shape.

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

This title is printed to order. This book may have been self-published. If so, we cannot guarantee the quality of the content. In the main most books will have gone through the editing process however some may not. We therefore suggest that you be aware of this before ordering this book. If in doubt check either the author or publisher’s details as we are unable to accept any returns unless they are faulty. Please contact us if you have any questions.

Long term deflation will cause all asset prices to collapse by 80-90%, so it's a golden opportunity to go from laborer to capitalist, from nothing to get rich, as long as you prepare ahead of time.

The Long Term Deflation is a war of survival: get rich or get wiped out. Very little economic data from 1929 remains for the United States. Japan's data from 1990 2023 is the only one worth analyzing and studying. Even globally, there is very little data on long term deflation, let alone the usual short term deflation line.

Japan's long term deflation data and so on, are thankfully updated and published monthly by FRED. It was a great pleasure for the author to be able to cite these sources to verify almost all of his arguments.

This book is the first general theory of long term deflation. In a nutshell, long term deflation is a proportional decline in the price of the dollar and the price of everything else in the world over a period of 5 to 30 years.

According to the author's diamond dollar investment method, the dollar and the price of goods should be inversely proportional. However, the opposite phenomenon occurs: a direct relationship between the dollar and the price of everything in the world, lasting 5 30 years.

If we analyze Japan in December 1988, the domestic dollar price and the Nikkei 225 stock price rose about 30% in proportion for about a year. It was a sign of the beginning of long term deflation.

Now, in South Korea, the domestic price of the dollar and the domestic stock market are surging.

The U.S. Great Depression of 1929 was the world's first long term deflation, and Japan's in 1989 lasted 32 years. In a long term deflation, the price of everything in the world, and the dollar, is constantly falling, so there is almost nothing to invest in, and the only asset that can be invested in is government bonds, which we will discuss in detail in this book.

This book is the first book to focus on this phenomenon of long term deflation, and it emphasizes why deflation should be divided into short term and long term deflation, and how these two types of deflation differ.

This book is not a research book or an economics text, but an investment theory book, and summarizes the results of research on long term deflation to be used as an investment method as much as possible. I have already announced that there is an investment order among the top five assets in the asset market.

It involves rotating through five assets: stocks, apartments, dollars, deposits, and government bonds. This is what the authors call the pentagon asset cycle investing method because it's a pentagonal shape.