Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

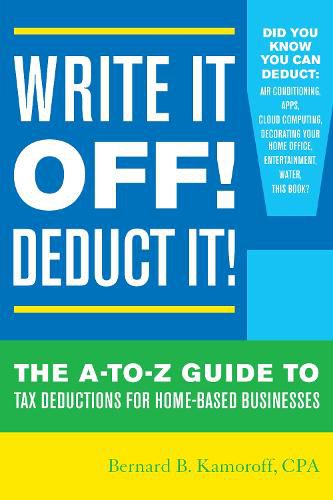

Are you paying more taxes than you have to?

There are more than nineteen million home-based businesses in the United States-56 percent of all businesses-and they generate $102 billion in annual revenue. As far as the IRS is concerned, a home business is no different than any other business. But there is a difference: not only can you deduct the business expenses that every business is entitled to, you can turn personal, nondeductible expenses into tax-deductible business expenses-if you are careful to follow the rules.

No tax software or accountant knows the details of your home-based business like you do, and the IRS is certainly not going to tell you about a deduction you failed to take. This invaluable book not only lists the individual items that are deductible in your home-based business-from utilities to that part of the home where you work-but also explains where to list them on your income tax forms.

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

Are you paying more taxes than you have to?

There are more than nineteen million home-based businesses in the United States-56 percent of all businesses-and they generate $102 billion in annual revenue. As far as the IRS is concerned, a home business is no different than any other business. But there is a difference: not only can you deduct the business expenses that every business is entitled to, you can turn personal, nondeductible expenses into tax-deductible business expenses-if you are careful to follow the rules.

No tax software or accountant knows the details of your home-based business like you do, and the IRS is certainly not going to tell you about a deduction you failed to take. This invaluable book not only lists the individual items that are deductible in your home-based business-from utilities to that part of the home where you work-but also explains where to list them on your income tax forms.