Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

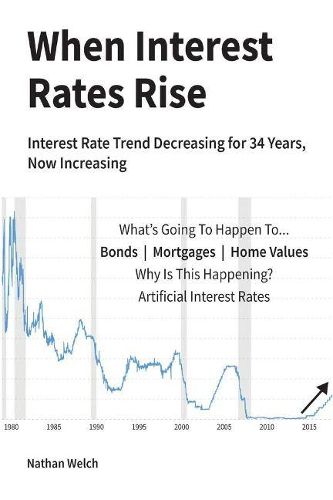

IT ALL STARTED…December of 2015, the interest rate trend made a change that hadn’t occurred in 34-years! Prior to this date, interest rates had been lowering. They are now increasing.This will have an effect on all levels of personal finance. It will also cause a complete change in asset performance and how assets are thought to perform. Bond values will decrease. Mortgage rates, home equity lines, and student loans will all increase. Dividend stocks will be less favorable as bond yields begin to compete. Learn how you can analyze the interest rates to help understand movements in the equity markets. Misconceptions could be a wealth killer. Learn about interest rate risks, as they have never been more important than they are now. When the trend changes everything gets flipped. This book will walk you through why this time is different than all others. After reading this book, you will never again look at interest rates in the same way.

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

IT ALL STARTED…December of 2015, the interest rate trend made a change that hadn’t occurred in 34-years! Prior to this date, interest rates had been lowering. They are now increasing.This will have an effect on all levels of personal finance. It will also cause a complete change in asset performance and how assets are thought to perform. Bond values will decrease. Mortgage rates, home equity lines, and student loans will all increase. Dividend stocks will be less favorable as bond yields begin to compete. Learn how you can analyze the interest rates to help understand movements in the equity markets. Misconceptions could be a wealth killer. Learn about interest rate risks, as they have never been more important than they are now. When the trend changes everything gets flipped. This book will walk you through why this time is different than all others. After reading this book, you will never again look at interest rates in the same way.