Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

This title is printed to order. This book may have been self-published. If so, we cannot guarantee the quality of the content. In the main most books will have gone through the editing process however some may not. We therefore suggest that you be aware of this before ordering this book. If in doubt check either the author or publisher’s details as we are unable to accept any returns unless they are faulty. Please contact us if you have any questions.

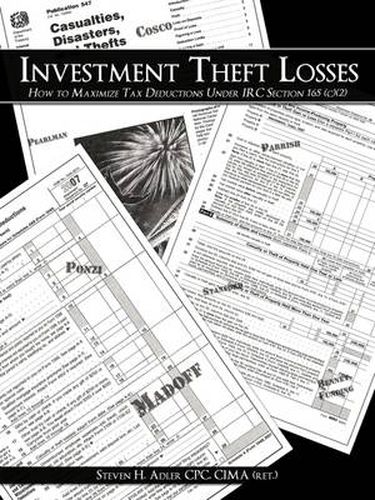

Investment Fraud accounts for billions of dollars of losses each year from unsuspecting victims. In 1954, Congress enacted Section 165 of the Internal Revenue Code. Its purpose was to give some relief to the victims of fraud. For many understandable reasons it was rarely utilized until about 8 years ago. This book is intended to be a practical way for tax professionals and taxpayers understand what is involved to claim the deduction.

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

This title is printed to order. This book may have been self-published. If so, we cannot guarantee the quality of the content. In the main most books will have gone through the editing process however some may not. We therefore suggest that you be aware of this before ordering this book. If in doubt check either the author or publisher’s details as we are unable to accept any returns unless they are faulty. Please contact us if you have any questions.

Investment Fraud accounts for billions of dollars of losses each year from unsuspecting victims. In 1954, Congress enacted Section 165 of the Internal Revenue Code. Its purpose was to give some relief to the victims of fraud. For many understandable reasons it was rarely utilized until about 8 years ago. This book is intended to be a practical way for tax professionals and taxpayers understand what is involved to claim the deduction.