Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

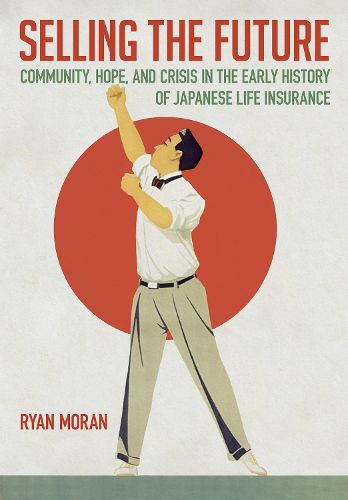

In Selling the Future, Ryan Moran explains how the life insurance industry in Japan exploited its association with mutuality and community to commodify and govern lives. Covering the years from the start of the industry in 1881 through the end of World War II, Moran describes insurance companies and government officials working together to create a picture of the future as precarious and dangerous. Since no single consumer could deal with every contingency on their own, insurance industry administrators argued that their usage of statistical data enabled them to chart the predictable future for the aggregate. Through insurance, companies and the state thus offered consumers a means to perfect the future in an era filled with repeated crises.

Life insurance functioned as an important modernist technology within Japan and its colonies to instantiate expectations for responsibility, to reconfigure meanings of mutuality, and to normalize new social formations (such as the nuclear family) as essential to life. Life insurance thus offers an important vehicle for examining the confluence of modes of mobilizing and organizing bodies, the expropriation of financial resources, and the action of disciplining workers into a capitalist system.

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

In Selling the Future, Ryan Moran explains how the life insurance industry in Japan exploited its association with mutuality and community to commodify and govern lives. Covering the years from the start of the industry in 1881 through the end of World War II, Moran describes insurance companies and government officials working together to create a picture of the future as precarious and dangerous. Since no single consumer could deal with every contingency on their own, insurance industry administrators argued that their usage of statistical data enabled them to chart the predictable future for the aggregate. Through insurance, companies and the state thus offered consumers a means to perfect the future in an era filled with repeated crises.

Life insurance functioned as an important modernist technology within Japan and its colonies to instantiate expectations for responsibility, to reconfigure meanings of mutuality, and to normalize new social formations (such as the nuclear family) as essential to life. Life insurance thus offers an important vehicle for examining the confluence of modes of mobilizing and organizing bodies, the expropriation of financial resources, and the action of disciplining workers into a capitalist system.