Readings Newsletter

Become a Readings Member to make your shopping experience even easier.

Sign in or sign up for free!

You’re not far away from qualifying for FREE standard shipping within Australia

You’ve qualified for FREE standard shipping within Australia

The cart is loading…

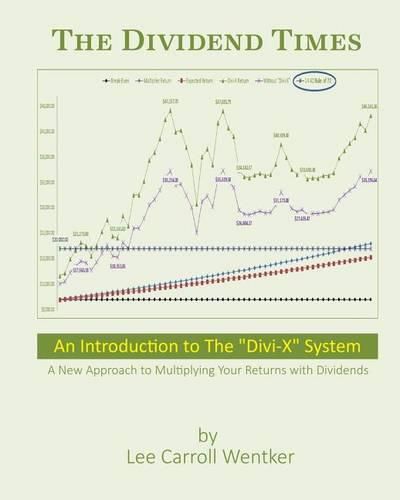

*UPDATE 01.01.2020*The stocks featured in ‘The Dividend Times’ have increased an additional 165.49% since publication for a total return of 296.79% (dividends are not reinvested or returns would be materially higher). Unleash the Real Power of Dividends! If you are looking for a book that is long on process and short on verification, this is not the book for you. If you are looking for a book that teaches you a simple process that you can use right away with ample evidence to back it up, you found it.If you’re worried that the examples used in this book might be outdated, don’t be. The longer you hold good performers, the better the returns (in appreciation and yield).This is not another book telling you that investing in ‘dividend paying securities’ is better for you in the long-term. This book takes ‘dividend investing’ to a whole new level. Before I tell you what you’ll learn, let’s take a look at what Divi-X has done after 5 years.Boeing Co (BA) Without Divi-X With Divi-X Cash Paid $4,484.00 $3,724.005YR Returns 198.11% 247.89%5YR Cash Value $7,377.53 $9,231.38 This is not a typo. Divi-X is actually yielding a higher cash/percentage return on a smaller cash investment. Here are a few more also using less cash: Merck & Co., Inc. (MRK) - Without Divi-X 119.37%, With Divi-X 165.54%AT&T (T) - Without Divi-X 76.23%, With Divi-X 106.71%Home Depot (HD) - Without Divi-X 264.44%, With Divi-X 343.44% Notice, that these examples are well-known stocks. Just about every American owns these stocks already whether they know it or not. And before you assume that I just gave examples of the best performers, they are not. Of the 29 DOW stocks that paid dividends for our five year test period (Sept. 2011 to Sept. 2016), Divi-X outperformed on 26 of those 29 for a 90% success rate. What of the three that underperformed? Two underperformed less than one half of one percent and the worst, led by IBM, was 5%. As always, past performance is not an indicator of future performance. We also ran the DOW stocks through the Divi-X System for the period of April 2009 to April 2014, and out of the twenty-nine DOW stocks that paid dividends at the time, Divi-X outperformed on 27 of those 29 securities, for an overwhelming 93% success rate. The two Divi-X underperformers were Goldman Sachs (19.3% to 18.4%) and Intel Corporation (12.4% to 9.4%). It’s also worth noting that these results are based on the most conservative use of the Divi-X System featured in the book. Is your investment horizon longer than five years? Over the last twenty years, Divi-X has outperformed every dividend paying stock in the DOW 100% of the time! How about that success rate? Here’s a sample of what you will learn: -How to set up your existing brokerage account to make these types of investments (your account may already be eligible) -How insanely easy the Divi-X System is -Improving your long-term prospects using various methods provided by the Divi-X System -How making one conscious decision when you ‘BUY’ can make all the difference between a good investment and an outstanding investment -Using the Divi-X System to accommodate your own investment style (low-risk, high-risk; short-term, long-term) -How your broker is unintentionally not showing you the true picture of your investment results. You could be holding your worst performers and selling your best performers. -Dividend Re-investing with Divi-X -How losers can actually be winners (I devote a segment on winning stocks using the Divi-X System that have actually declined in share price and still had decent returns) -Measure risk that you can control-And more The Divi-X System is not a stock-picking strategy guide. The strategy in this book can result in loss of principal. Use at your own risk!

$9.00 standard shipping within Australia

FREE standard shipping within Australia for orders over $100.00

Express & International shipping calculated at checkout

*UPDATE 01.01.2020*The stocks featured in ‘The Dividend Times’ have increased an additional 165.49% since publication for a total return of 296.79% (dividends are not reinvested or returns would be materially higher). Unleash the Real Power of Dividends! If you are looking for a book that is long on process and short on verification, this is not the book for you. If you are looking for a book that teaches you a simple process that you can use right away with ample evidence to back it up, you found it.If you’re worried that the examples used in this book might be outdated, don’t be. The longer you hold good performers, the better the returns (in appreciation and yield).This is not another book telling you that investing in ‘dividend paying securities’ is better for you in the long-term. This book takes ‘dividend investing’ to a whole new level. Before I tell you what you’ll learn, let’s take a look at what Divi-X has done after 5 years.Boeing Co (BA) Without Divi-X With Divi-X Cash Paid $4,484.00 $3,724.005YR Returns 198.11% 247.89%5YR Cash Value $7,377.53 $9,231.38 This is not a typo. Divi-X is actually yielding a higher cash/percentage return on a smaller cash investment. Here are a few more also using less cash: Merck & Co., Inc. (MRK) - Without Divi-X 119.37%, With Divi-X 165.54%AT&T (T) - Without Divi-X 76.23%, With Divi-X 106.71%Home Depot (HD) - Without Divi-X 264.44%, With Divi-X 343.44% Notice, that these examples are well-known stocks. Just about every American owns these stocks already whether they know it or not. And before you assume that I just gave examples of the best performers, they are not. Of the 29 DOW stocks that paid dividends for our five year test period (Sept. 2011 to Sept. 2016), Divi-X outperformed on 26 of those 29 for a 90% success rate. What of the three that underperformed? Two underperformed less than one half of one percent and the worst, led by IBM, was 5%. As always, past performance is not an indicator of future performance. We also ran the DOW stocks through the Divi-X System for the period of April 2009 to April 2014, and out of the twenty-nine DOW stocks that paid dividends at the time, Divi-X outperformed on 27 of those 29 securities, for an overwhelming 93% success rate. The two Divi-X underperformers were Goldman Sachs (19.3% to 18.4%) and Intel Corporation (12.4% to 9.4%). It’s also worth noting that these results are based on the most conservative use of the Divi-X System featured in the book. Is your investment horizon longer than five years? Over the last twenty years, Divi-X has outperformed every dividend paying stock in the DOW 100% of the time! How about that success rate? Here’s a sample of what you will learn: -How to set up your existing brokerage account to make these types of investments (your account may already be eligible) -How insanely easy the Divi-X System is -Improving your long-term prospects using various methods provided by the Divi-X System -How making one conscious decision when you ‘BUY’ can make all the difference between a good investment and an outstanding investment -Using the Divi-X System to accommodate your own investment style (low-risk, high-risk; short-term, long-term) -How your broker is unintentionally not showing you the true picture of your investment results. You could be holding your worst performers and selling your best performers. -Dividend Re-investing with Divi-X -How losers can actually be winners (I devote a segment on winning stocks using the Divi-X System that have actually declined in share price and still had decent returns) -Measure risk that you can control-And more The Divi-X System is not a stock-picking strategy guide. The strategy in this book can result in loss of principal. Use at your own risk!